Also in the news...

France: providing services and travelling for business

Guidance for UK businesses on rules for selling services to France.

Living in the USA

Information about moving to, living or retiring in the USA Ė including visas, working, healthcare and driving.

Trade with Liechtenstein

How you import from and export to Liechtenstein

UK trade with the United States: Impact of tariffs on imports and exports of goods

A closer look at the goods the UK trades with the United States in the context of trade tariffs.

Simplified rates for bringing personal goods into the UK

Find out about the simplified rates of customs and excise duty used when you declare your personal goods online.

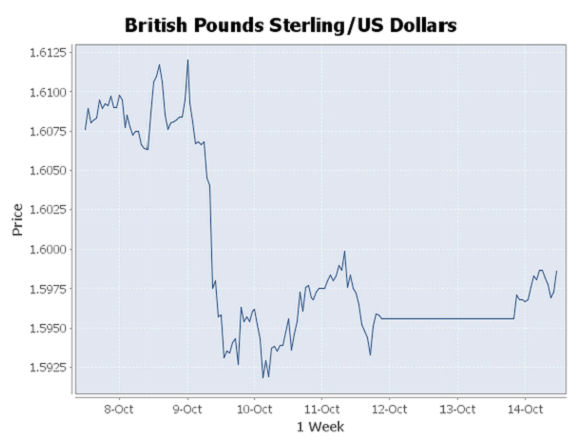

Start Up Overseas Weekly Currency Report

Towards the end of last week, the dollar continued to look firmer into trading, showing signs that US congregational leaders are reaching a short-term debt agreement.

Strong unemployment claims figures helped the dollar to remain competitive, while below expected French industrial production figures showed the euro to be kept on the sidelines. The Bank of England also announced its interest rate decision on Thursday, whereby the decision reflected the central bank to keep rates and asset purchases on hold.

The World Bank and IMF began their annual meeting on Friday the 11th October, although this was being somewhat overshadowed by the US government debt talks. The government even looks closer to achieving an agreement to lift the debt ceiling until mid-November.

Government talks over raising the US debt ceiling have continued over the weekend yet it seems the government hasnít come to an agreement yet with four days left to go. US government issues are helping sterling edge slowly back towards the 1.60 mark despite the poor UK figure last week.

The euro looks to take control of the GBP/EUR and EUR/USD rate today with industrial production figures due at 10:00- a solid figure here could see the single currency strengthen further, leaving the pound on the back foot with eurozone industrial production dictating the direction of this pair today.