Also in the news...

France: providing services and travelling for business

Guidance for UK businesses on rules for selling services to France.

Living in the USA

Information about moving to, living or retiring in the USA – including visas, working, healthcare and driving.

Trade with Liechtenstein

How you import from and export to Liechtenstein

UK trade with the United States: Impact of tariffs on imports and exports of goods

A closer look at the goods the UK trades with the United States in the context of trade tariffs.

Simplified rates for bringing personal goods into the UK

Find out about the simplified rates of customs and excise duty used when you declare your personal goods online.

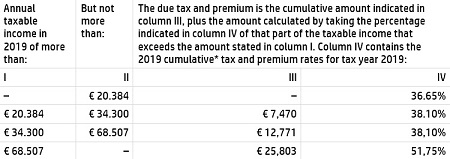

Personal income tax rates 2019

Personal income tax rates applicable for tax year 2019. Personal income tax rates 2019 for income from (former and/or self-) employment and home ownership (also referred to as “box 1”):

* – premium part in IV respectively: 27.65% / 27.65% / 0% / 0%, tax part in IV respectively: 9% / 10.45% / 38.10% / 51.75%. These rates apply to persons who have not yet reached AOW (State pension) age or the year in which they reach AOW age. Please note that several tax rebates (“heffingskortingen”) may apply, these tax rebates lower the tax and premium payable. These tax rebates have however not been applied in the above table.

Personal income tax rate 2019 for income from substantial share ownership, applicable when owning 5% or more of the shares in a limited company (also referred to as “box 2”): 25% flat tax rate on all earnings following from these shares, such as dividends and capital gain.

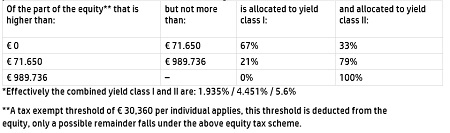

Personal income tax rate 2019 for income from equity:30%flat tax rate on (progressive) deemed interest made on equity. In brief equity can be summarized as (worldwide held) assets minus (worldwide held) debts. The point of departure is the value of the equity per beginning (January 1st) of the relevant tax year. Based upon this value the deemed taxable income (benefit from savings and investments) is calculated.

The benefit from savings and investments is set at 0.13% of the part of the basis for savings and investments that belongs to yield class I, plus 5.60% of the part of that basis that belongs to yield class II. The height of the part of the basis for saving and investing that belongs to yield class I or yield class II, is determined on the basis of the following table*:

An example of the above equity tax table: A single individual has an equity of € 130,360 per January 1st 2019. After applying the threshold a taxable equity remains of € 100,000. The actual income made on this equity is not relevant, nor is relevant how this equity has been invested, e.g. as bank savings and/or (partially) invested in stock. Both the taxable interest as well as the kind of investment is fictitious. The first € 71,650 is effectively deemed to have made an interest income of 1.935% (67% x 0.13% plus 33% x 5,6%) is € 1,386. The second part € 100,000 -/- € 71,650 = € 28,350 is effectively deemed to have made an interest income of 4.451% (21% x 0.13% plus 79% x 5,6%) is € 1,261. Total deemed interest is 2,647 x 30% tax =total amount on equity tax is € 794.

The idea behind the two different yield classes is that individuals with more equity are deemed to take more risk by investing in stock, yield class I is the low interest bank savings account and yield class II are the higher interest giving stocks. There is however no counter proof possibility within the law for individuals with a high amount on equity put in low interest bank saving accounts. Based upon case law dealing with double interest fictions, there may be acounter proof possibility in case the actual interest is at least 10% lower than the deemed interest.Court procedures are expected regarding the above explained equity deemed interest income system.Be sure to object on time.