Also in the news...

France: providing services and travelling for business

Guidance for UK businesses on rules for selling services to France.

Living in the USA

Information about moving to, living or retiring in the USA – including visas, working, healthcare and driving.

Trade with Liechtenstein

How you import from and export to Liechtenstein

UK trade with the United States: Impact of tariffs on imports and exports of goods

A closer look at the goods the UK trades with the United States in the context of trade tariffs.

Simplified rates for bringing personal goods into the UK

Find out about the simplified rates of customs and excise duty used when you declare your personal goods online.

Mauritius Company Registration Investment Dealer Broker License

Registration And Licensing In Mauritius Investment Dealer – Broker

The reputation of Mauritius as an International Financial Centre rests on the quality of its services and its pool of highly qualified professionals.

The Financial Services Act (FSA) adopted in 2007,simplifies the regulatory regime and consolidates the legislative framework of the global business sector.

The Investment Dealer licenses as issued by the Financial Services Commission in Mauritius are getting increasing popularity among many of the Brokerage Houses worldwide.

Application for Investment Dealer license must be made under a Category 1 Global Business Company and license is granted subject to the approval of the Financial Services Commission.

The Securities Act 2005 coupled with the Securities (licensing) Rules 2007 remain the main legal framework governing the provisions and setting the parameters within which a GBC 1 with an Investment Dealer license can operate.

There are different categories of Investment Dealer license and Securities (licensing) Rules 2007 clearly set out the activities authorized to be carried out under each category.

Being Licensed In Mauritius

Licensed Activities

The Financial Services Rules 2008

Consolidated Licensing And Fees

The Financial Services Rules 2008 (the Rules) set out the licensing framework that provides for a comprehensive codified list of financial services and financial business activities licensable by the FSC.

The licensing framework provides clear sets of licensing criteria and requirements within a well-defined and consolidated framework. Prospective applicants, including service providers, may consult legal provisions, licensing requirements and fees applicable to the particular business they intend to conduct.

The FSC considered the level of development of the different sectors under its purview as well as the need to sustain the overall competitiveness of Mauritius as an International Financial Centre, in determining the fee structure.

The Rules also provide for a specific code for each of the licensable financial services and financial business activities.

Applying For A License

In order to carry out global business and other financial services in Mauritius, individuals or entities must apply for a licence from the FSC.

Licenses available for application in Mauritius are:

Global Business

Insurance & Pension

Capital Markets

Other NBFIs

Applying For A License

Capital Markets

Entities operating in the Capital Markets sector are licensed under the Securities Act(SA). The SA provides a comprehensive framework enabling entities to operate in full transparency and lists all the requirements/criteria and the prudential norms which need to be followed and the relevant disclosures.

The FSC licences securities exchanges, clearing and settlement facilities, securities trading systems, market intermediaries, Collective Investment Schemes (CIS) and Closed-end fund (CEF), CIS Functionaries and also registers Reporting Issuers and Investment Clubs.

Registration And Licensing In Mauritius

Investment Dealer – Broker

Definition As In Securities Act 2005

Authorised to execute orders for clients, to manage portfolios of clients and to give advice on securities transactions to clients.

Type of entity required to be eligible – GBC1;

DTA – Double Taxation Agreements benefits – Yes;

Taxation – Maximum 3% on profits;

Time To Incorporate

Time to incorporate – Approximately 3 to 4 weeks’ time if all documents provided and FSC satisfied with same;

Financial Statements

Financial Statements Disclosure to FSC – File audited financial statements within 90 days of financial year end;

Staff Qualification

Staff Qualification – At least two officers/representatives/board members having at least 4 years of relevant experience/skills in this field.

Benefits Of A Gbc1 Company

A GBC 1 benefits from a deemed tax credit so that it will end up paying a maximum effective tax rate of 3% on its tradable profits;

There is no capital gains tax and no withholding tax on dividends, interest and royalties paid by a GBC 1 company;

As soon as a GBC 1 is qualified as tax resident in Mauritius, it will benefit from the tax treaty network;

There is no minimum capital requirement for a GBC 1 and the stated capital can be denominated in any currency except Mauritian Rupee;

A GBC 1 is allowed to have either par value (which may be stated in more than one currency) or no par value shares. The shares can be in the form of registered shares, preference shares, redeemable shares and shares with or without voting rights. Bearer shares are not permissible in the case of a GBC 1;

Both individual and corporate bodies are allowed to be shareholders of a GBC 1;

There is no statutory requirement for a GBC1 to have a constitution. In the absence of the latter, the company will be governed by the provisions under the Companies Act 2001. The shareholders of the GBC 1 may adopt a constitution at any time through a special resolution;

It is to be noted that it is possible to apply for occupational permit for expatriates who are employees of the GBC 1 Company;

Main Characteristics Of A Gbc1

A GBC 1 must have a minimum of two (2) Resident Directors in order to avail of treaty benefits, with board meetings held in Mauritius. It is to be noted that the concept of Corporate Director is not applicable in case of a GBC 1;

A GBC 1 must at all times have a Resident Secretary and a Registered Office in Mauritius;

In addition, a GBC 1 must have a local auditor and a local bank account;

A GBC 1 must file an annual tax return with the Mauritius Revenue Authority (MRA);

A GBC 1 must also file its audited financials prepared in accordance with internationally acceptable accounting standards, not later than 6 months after its financial year end;

The shareholders of a GBC 1 must hold an Annual Meeting in every calendar year and within 6 months of the company’s balance sheet date;

It is to be noted that the names of shareholders and beneficial owners coupled with their corresponding due diligence documents must be disclosed to the FSC.

However, such information, in addition to any filing and return of the GBC 1 with the Registrar of Companies, are not available for public inspection;

Accounting records and statutory records such as register of members, register of directors, minutes of all directors’ and shareholders’ meetings and resolutions, amongst others, must be kept at all times at the registered office of the GBC 1.

Conversion of a GBC 1 into a GBC 2 is permissible.

A company having a GBC 1 status is given the highest degree of confidentiality under Mauritius law and no information regarding its shareholding, accounts or activities are publicly accessible.

The timeline for incorporating a GBC 1 company varies from 5 to 10 days.

Brief On Investment Dealers

The Securities Act 2005 and rules & regulations made under it allow for Investment Dealer Companies to be set up and licensed in Mauritius. These are particularly beneficial for Brokerage Houses operating worldwide.

Mauritius has the advantage of having a modern and flexible Securities Law, it issues clear Investment Dealer licenses within a reasonable time, requires reasonable minimum capital requirement, charges reasonable licence fees and has a low tax rate.

Minimum Unimpaired Stated Capital fully Paid – MUR 700,000 – approx. USD 24,000 for an Investment dealer Broker license.

Mauritius is one of the best places to save on costs for Brokerage Houses and at the same time enjoy the array of service providers in the country.

Investment Dealer Categories

Under The Security Act

Full Service Dealer with or without Underwriting Authorised to:

Act as an intermediary in the execution of securities transactions for clients;

Trade in securities as principal with the intention of reselling these securities to the public

Underwrite or distribute securities on behalf of an issuer or a holder of securities (if this option is chosen);

Give investment advice which is ancillary to the normal course of his business activities; and

Manage portfolios of clients.

Discount Broker Authorised to:

Execute orders for clients without giving advice.

Broker Authorised to:

Execute orders for clients, to manage portfolios of clients and to give advice on securities transactions to clients.

Investment Dealer (Commodity Derivatives Segment) Authorised to:

Act as broker in Commodity Derivatives only.

Investment Dealer (Currency Derivatives Segment) Authorised to:

Act as broker in Currency Derivatives only.

Investment Dealer Licence

Difference Between Sec-2.1a And Sec-2.1b

Capital Requirements

Full Service Dealer – Including Underwriting – Sec-2.1A

This type of company is licensed by the FSC and is engaged in the business of trading in securities. It is authorised to:

Act as an intermediary in the execution of securities transactions for clients;

Trade in securities as principal with the intention of reselling these securities to the public;

Underwrite or distribute securities on behalf of an issuer or a holder of securities[This is the difference between 2.1 A and 2.1 B];

Give investment advice which is ancillary to the normal course of its business activities; and

Manage portfolios of clients.

Capital requirement: The minimum stated fully paid capital of a company holding a Full Service Dealer (Including Underwriting) licence is MUR 10,000,000 – circa USD 358,000.

Full Service Dealer – Excluding Underwriting – SEC-2.1B

This type of company is licensed by the FSC and is engaged in the business of trading in securities. It is authorised to:

Act as an intermediary in the execution of securities transactions for clients;

Distribute securities on behalf of an issuer or a holder of securities;

Give investment advice which is ancillary to the normal course of its business activities; and

Manage portfolios of clients;

Capital requirement: The minimum stated fully paid capital of a company holding a Full Service Dealer (Excluding Underwriting) licence is MUR 1,000,000 – circa USD 35,800.

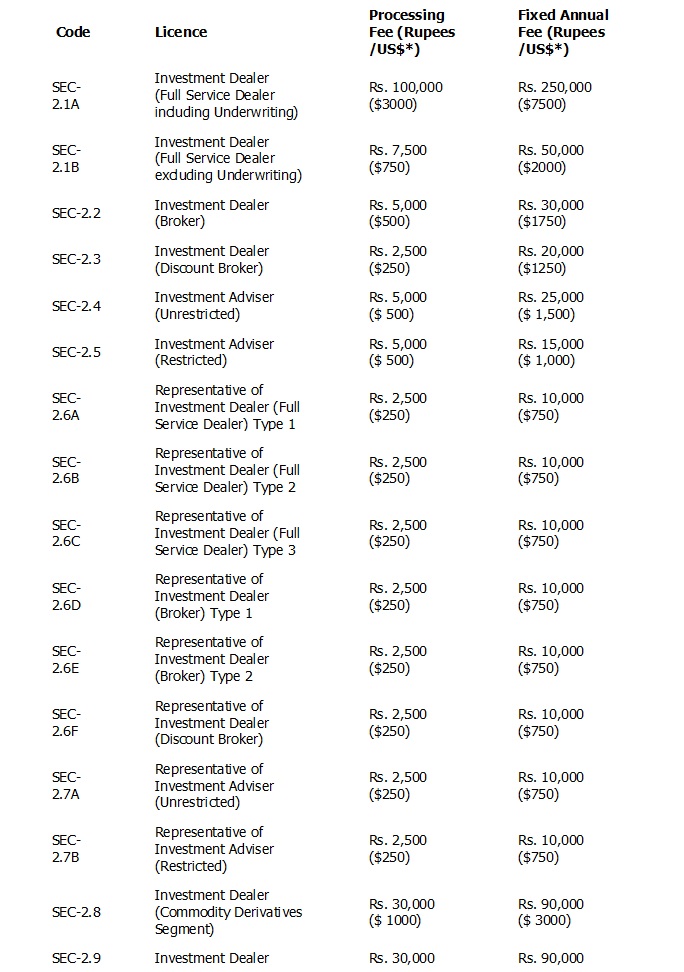

Investment Dealer License

Processing And Application Fees

* The fees set out in US$ shall be applicable only to an applicant for a Global Business Licence or a corporation holding a Global Business Licence, and its representatives respectively.

Investment Dealer Broker License

Under The Security Act

Financial services and securities included:

(a) Keeping, investing and managing money, securities and investment portfolios on behalf of third parties;

(b) shares or stocks in the share capital of a company, whether incorporated in Mauritius or elsewhere, other than a collective investment scheme;

(c) debentures, debenture stock, loan stock, bonds, convertible bonds or other similar instruments;

(d) rights warrants, options or interests in respect of securities mentioned in paragraphs (a) and (b);

(e) treasury bills, loan stock, bonds and other instruments creating or acknowledging indebtedness and issued by or on behalf of or guaranteed by the Government of the Republic of Mauritius or the government of another country, a local authority or public authority, as may be prescribed;

(f) shares in, securities of, or rights to participate in, a collective investment scheme;

(g) depository receipts or similar instruments;

(h) options, futures, forwards and other derivatives whether on securities or commodities;

(i) any other transferable securities, interests or assets as may be approved by the Commission;

Or

(j) any such other instruments as may be prescribed.

Remark:

The Investment Dealer is allowed to take money from the client by asking him to open an account with the Dealer. However, this money should be exclusively used for securities transactions.

Ongoing Registration Or Licensing Obligations

Besides all services related to the start-up of the Company, there are ongoing obligations that flow from having a Mauritius Investment Broker license;

Depending on the nature of the financial service, these requirements may include (a) written client agreements, (b) pre-investment disclosure documents and (c) anti-money laundering & know-your-client obligations.

List Of Documents Required For

Application As An Investment Dealer

1. Company Application Form to be filled and signed

2. Organisational/structure chart showing board of directors, shareholders, list of senior persons (compliance officer, Money Laundering Reporting Officer and deputy) and other officers who will would be responsible for the day to day operations;

3. Business plan with 3 year projections giving details of proposed activities, types of customers, products and services to be offered (brokerage, CIS securities, underwriting, etc.);

4. Draft agreements to be entered into with a Securities/ Commodities Exchange and agreements with Clients;

5. Draft brokerage agreement to be entered into with clients

6. An Internal Procedures Manual;

7. An Anti-Money Laundering & Compliance Procedures Manual;

8. Details of proposed membership with an Exchange, clearing and settlement facility, etc;

9. Details of procedures and systems to prevent conflicts of interest, terrorism and money laundering;

10. Confirmation Letter that the Investment Dealer will maintain the minimum capital required and will not start operation until this is paid in a bank account.

11. An indication as from where the company intends to operate;

12. Indication of the profile and location of the target clients of the company;

13. Details of the modus operandi of the company (mode of operation);

14. Confirmation whether the company will have a trading platform and details thereof;

15. Due diligence documents on directors, shareholders, all officers, beneficial owners, etc. as per below:

Passports

Certified to be true copy by an attorney, notary public, solicitor, public accountant, director of a trust company (‘Approved Certifier’).

Bank reference Letter

Original letter of reference from your bank, confirming the length of time the account has been opened (should be minimum 2 years) and that it has been conducted satisfactorily.

Curriculum Vitae (duly signed)

Stating qualifications, work history, qualification, experience/expertise in investment/securities management and present occupation. It should also include details of the source of the funds from the shareholder or beneficial owner only. It is also important to have the CV of the officer who has the experience and qualifications required under the Securities Act 2005 and that is clearly mentioned in the CV;

Personal Questionnaire (to be filled and signed)

Proof of address

Utility Bill/Credit card statement / Bank statement-less than 3 months old;original or certified copy by Approved Certifier.

Kindly note that the above documents are required for successful application of a Category 1 Global Business Licence and Investment Dealer.

Content supplied by TBA & Associates