Also in the news...

France: providing services and travelling for business

Guidance for UK businesses on rules for selling services to France.

Living in the USA

Information about moving to, living or retiring in the USA – including visas, working, healthcare and driving.

Trade with Liechtenstein

How you import from and export to Liechtenstein

UK trade with the United States: Impact of tariffs on imports and exports of goods

A closer look at the goods the UK trades with the United States in the context of trade tariffs.

Simplified rates for bringing personal goods into the UK

Find out about the simplified rates of customs and excise duty used when you declare your personal goods online.

Hungarian Accounting Act Amendment Now In Force

Hungarian Accounting Act amendments regarding mainly the form and content of the Financial Statements (FS) were passed by the government last year, and have been in effect since 1 January 2016

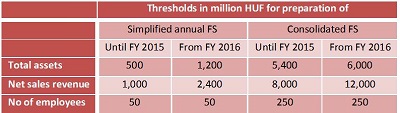

The changes in connection with the form of the FS enable the majority (approx. 97-98%) of Hungarian undertakings to prepare and publish simplified annual FS, since the thresholds have doubled. Those who are obligated to compile consolidated FS and previously had their total assets, net sales revenue and number of employees around the upper limits are now given an administrative facilitation as a result of threshold increases – although not as much as in the case of the simplified annual financial statements.

The principle-based approach of IFRS is still very far from the rules-based Accounting Act, however, we can say that last year’s amendments regarding the content and the definitions used by the Act make it a bit easier for foreign investors to understand the FS under Hungarian rules.

The most important examples to show this include the change in the definitions of parent company that is closely reflecting the IFRS rules, even if there are still differences, and the content of profit and loss statement.

In the future, P&L will no longer detail the so-called ‘balance sheet profit’ that consists of the profit after tax increased by the amount of retained earnings used for dividend declaration and decreased by the dividend declared, but will only show the breakdown of profit after tax.

This is a direct consequence of the changed regulation of dividend accounting that will happen in the year when the dividend has been approved rather than declaring it in the preceding year’s FS, as was previously the case.

Furthermore, extraordinary income and expense can now not be shown separately: items previously qualifying as such will be recorded among other income/expense or financial income /expense, just as according to IFRS.

Along with the now-obligatory compliance with Directive 2013/34/EU of the European Parliament, the Hungarian government has given certain companies the option or the obligation to prepare separate financial statements in accordance with IFRS.

The change is warmly welcomed both from administrative and from business perspectives, as IFRS reporting will result in cost savings and can give investors better comparisons and judgements through transparent, international and well-known principles that may boost competitive edge.