Offshore

Latvia in Offshore

Recent forum posts

-

Academic Writing Services

Quality Dissertation is well known for delivering high quality assignment writing help, dissertation writing help, coursework writing help and essay writing help to UK university and college students. Our academic assistance service comes at a very affordable price. With a team of writers, specialised in different subject areas, we are able to assist all students for different field of studies.

Total Posts: 9 Last post by jasminandeson31

-

Human Resource Assignment Help

Looking for top-notch Human Resource assignment help? Look no further than MyAssignmentHelp.co.uk! Our platform offers comprehensive assistance tailored to your HR needs. Whether you're tackling topics like recruitment, employee training, performance evaluation, or organizational behavior, our expert team is here to guide you

Total Posts: 1 Last post by ameliawillson

Latvia Company Formation Services

Latvia General Overview

Situated in north-eastern Europe with a coastline along the Baltic Sea, Latvia is geographically the middle of the three former Soviet Baltic republics.

It has language links with Lithuania to the south and historical and ecumenical ties with Estonia to the north.

Why Latvia

Latvian Company is a key element for successful business in Europe and worldwide

Latvia is a well-known European jurisdiction, financial centre of Eastern Europe, offers convenient taxation for trading and holding companies.

Since January 2013 Latvian companies became even more attractive for foreign clients, thus making them a top choice for tax optimization in Europe.

Latvia A New Tax Haven In The Eu

The Advantages Of Latvian Companies

Latvia in the centre of Europe is a highly attractive destination for several reasons.

European Union membership - An open market economy - a secure business environment;

An excellent geographical location in the centre of Europe between Scandinavia, Russia and Western Europe;

Highly skilled and professional labour force with fluent international communication in English and Russian;

A business friendly environment: One of the lowest tax rates in the Europe;

Schengen Area membership, free travel within Europe;

Daily flight connections to the major business centres in Europe;

Latvia is an EU member;

EU membership is the most important advantage. When incorporating the Latvian company, you get all the advantages and possibilities of European Union business at once. The more, Latvia is a rather new country and the legislation system is more liberal than in the other EU countries. In meaning, that all the process of incorporating the Latvian company is much easier, cheaper and also faster in comparison with the other EU countries. This advantage relates to the rest of Baltic states - Lithuania and Estonia, as well.

Latvia Schengen Agreement Member

The Schengen Agreement membership gives Latvia a major advantage. By this agreement, a Latvian residence allows to enter and leave the country without passport controls. If you are a company founder, you may get Latvian residence permit for 1 to 5 years.

Latvia A Tax Friendly Country

Attractive taxes. In addition, remarkable is the fact that Latvia has one of the best and gentlest tax system in Europe. For example, the corporate income tax rate is fixed at 15% which is one of the lowest in the EU. There is no dividend tax when dividends are paid out to corporate shareholders (except tax havens). Micro-enterprises pay 9% tax from the annual turnover. These are just some of the "attractive" Latvian taxation examples.

Easy business environment and rules

Furthermore, the company formation in Latvia is very easy and little effort and time consuming. Not for nothing, Latvia is ranked 21st in the world for ease of doing business (World Bank report). The main reasons for it:

The registration of a company is processed by the company register in just three business days.

No restrictions in owning or managing the Latvian company. You can be both individual and legal person to run the company. The same relates if you are not a resident. If you are non-resident, the same laws and rules apply to you, as well as they apply to local residents.

You don't need to be present at all; you actually can register a company remotely, with no physical presence required.

A transparent legal and judicial system, lawful treatment to foreign investors;

Euro in 2014

Conclusion

The enlargement of the Eurozone with Latvia and its tax regime offers interesting opportunities for international entrepreneurs in the Eurozone and its Eastern neighbours.

Should it be called a tax haven? We’re not sure.

Maybe the EU countries that are still being called ‘tax havens’ should be considered as normal. France, Belgium and Portugal should be regarded as tax hells...

Company Registration In Latvia

Positioned at the crossroads of northern and eastern Europe, the Baltic state of Latvia is rapidly making the most of its recently-acquired status as a member of the EU. Foreign investment is rising strongly and Latvian authorities have taken steps to streamline the regulations governing company formation. The most popular business entity is the limited liability company (SIA). Corporate tax rate is fixed at 15%, one of the lowest in the EU.

A company in Latvia is well positioned to be an effective European intermediary for trade between Western and Eastern, “Russian- speaking” countries. Latvia is a multi-lingual society where all three Latvian, Russian and English languages are commonly spoken and professionals are adept at working with both Western and Eastern business cultures. Latvian banks are extremely efficient and well-developed (compared with often bureaucratic Russian banks), and can maintain accounts in all currencies including “soft” ones, such as Russian Roubles.

Benefits Of Latvian Companies

- European jurisdiction with excellent reputation

- Low taxes

- Low administration costs

- Short incorporation time (2-3 business days with your own name)

- European VAT number

- Stable legislation

- Easy and comprehensive accounting

- Personal visit is not obligatory

- Developed banking and financial sector

- Close geographical location

Requirements For Company Formation In Latvia

- Minimum share capital of Latvian company to be deposited: €3090, at least half to be paid up.

- Minimum one director is required for company registered in Latvia. No restrictions on foreign shareholders or directors in Latvian company.

- Registered company office address (no P.O. Box allowed)

Taxation In Latvia

Double taxation treaty with more than 50 countries all over the world, including EU countries, Switzerland, Norway, Russia, Israel, China, USA, Canada and many others.

As a part of EU, Latvian companies have European VAT number enabling to trade both with EU and non-EU companies VAT free.

Incorporation takes 2-3 business days and there is no need for a client to personally visit Latvia neither for company formation, nor for bank account opening.

We co operate with largest Latvian banks.

Current General Figures

Corporate income tax - 15% *

Dividend tax - 0%

Tax on interests - 0% **

Tax on royalties - 0% **

Capital Gains Tax - 0%

Value Added Tax (VAT) - 0% ***

* сan be reduced by expenses or agent agreement

** from 2014

*** for export, 21% for most of the goods/services in Latvia

Latvia Types Of Company

Company formation in Latvia is governed by a new Commercial Code effective 1 January 2002. Influenced by German law, the Code brings Latvian commercial law in line with European Union directives, and simplifies commercial law particularly by reducing the number of available business vehicles from 13 to 5. Protection of creditors' and minority shareholders' interests has been given greater attention especially where reorganization of the company or the reduction of capital takes place. The Code is explicit about the liability of company managers and for the first time provides detailed rules for dissolution, liquidation and reorganisation of commercial partnerships and companies.

The code has reintroduced the legal term "Firma" which is used by a business merchant when concluding and signing contracts. It also abolishes limitations in the use of foreign languages by a Firma.

Currently foreigners are allowed to carry out business activities in Latvia in the form of: a limited liability company (SIA); stock company (A/s – public or closed); or as a branch of a company. It is also possible to register a representative office for the sole purpose of advertising and promoting a business. Representative offices may no longer be used for the actual conduct of business.

There are no restrictions on the ownership of Latvian companies by foreign investors. The overwhelming majority of Latvian businesses are launched as limited liability companies.

In order to be a legal entity and to undertake business activities all companies must be registered with the Latvian Registry of Companies and also as taxpayers with the State Revenue.

A company is formed by filing certain prescribed documents with the Companies' registry. The registration procedure would normally be carried out on behalf of the foreign investor by lawyers or other professional advisers.

Registration fees payable to the Government upon registration are:

- LVL 250 for a stock company;

- LVL 100 for a limited liability company;

- LVL 20 for a Branch;

- LVL 20 for a representative office.

Documents have to be filed with the Registry in Latvian. Documents in other languages have to be translated and notarized. All company documents filed with the Registrar are open to public inspection at a nominal charge.

Latvian company law calls for the creation of a three-tier governing structure – the shareholders' meeting, the management board and the supervisory board (optional for limited liability companies). At least half of the members of the management board must be domiciled in Latvia.

Both limited liabilities and stock companies have legal personality, distinct from that of their shareholders. Shares in a company represent a portion of corporate capital and entitle the holder to proportional right to corporate assets on dissolution. There is no minimum or maximum amount of shares that a company is allowed to issue, unless otherwise specified in the incorporating documents. "One shareholder" companies are also permissible under Latvian law.

Latvia Limited Liability Company

The most common form of a business presence in Latvia is a limited liability company. The minimum share capital required to establish a limited liability company is Ls 2000 which has to be paid before registration with the Commercial Register. Share capital may be contributed in kind.

The following documents are required in setting up a limited liability company in Latvia:

- Application form which must be signed by all founders. Signatures and capacity of signatories must be certified by a notary.

- Any power of attorney (notarised) issued by a founder to another person, authorizing such a person to sign the application.

- Shareholders agreement signed by all founders. Signatures must be notarised. In case of a sole founder the Memorandum is replaced by a Resolution on Incorporation. - Copies of the founders’ passports.

- Articles of association signed by all founders; signatures must be notarised.

- Confirmation letter from the bank (in case of monetary contributions).

- Statement regarding any investments in kind.

- Each Council member’s consent to act as a Council member (If the company has established a Council).

- Passport of the copies of the members of the Council.

- Each Board member’s consent to act as a Board member.

- Passport copies of the Board members.

- Notarised signature samples of the Board members having representation rights.

- The Board’s confirmation of the company's address.

An LLC is prohibited from offering its shares to the public or from trading on the Stock Exchange. The shareholders' liability is limited to the amounts of the capital invested. Share certificates and registration of the shareholders is recorded in the "Shareholders Register". An LLC may issue only registered shares.

A Public Limited Liability Company (with the suffix AS) has a minimum registered share capital of LVL 25,000 (approximately Euro 38,000). The company may offer its shares to the public.

Latvia Joint Stock Company

Joint Stock Companies may issue both registered and bearer shares as well as bonds. Statutes of the joint stock company may provide for the conversion of registered shares into bearer ones and vice versa. A joint stock company is generally entitled to issue different classes of shares which may confer on their holders different rights, such as voting rights, rights to fixed dividends, and a right of priority on winding up, etc. Joint stock companies are entitled to issue non-voting preference shares subject to the provisions of the statutes.

The minimum requirement for the registered share capital of a joint stock companies is set at LVL 25,000. Higher capital requirements apply in respect of joint stock companies operating in banking and insurance.

Shares may be paid up in money or in kind.

Joint stock companies are entitled to issue employees' shares, which should be covered by the profit of the company. The total value of issued employees' shares may not exceed 10% of a company's subscribed share capital. The employees' shares are not transferable and cannot be inherited.

Latvia Representative Office

A non-resident's representative office can be incorporated for an initial period of five years which may be extended for a further five if requested. There are no legal limits to the number of extensions permitted.

The following documents are required:

- A legalised copy of the articles of association of the parent company;

- A legalised copy of the foreign registration certificate of the parent company;

- An authorised and legalised decision of the parent company to establish the RO in Latvia;

- An authorised and legalised decision appointing the head of the RO;

- A document (passport, lease agreement) confirming the legal address of the RO;

- A notarised signature sample of the head of the RO;

- Copy of the RO head's passport.

The application for registration and the foundation documents must be submitted to the Enterprise Register within 14 days of the ratification of the RO by-laws.

Latvia Branch

Branches of foreign companies in Latvia have no legal personality. However a branch of a non-resident company is treated by the law as a separate Latvian taxpayer subject to the same reporting and audit requirements as are applied in respect of local companies.

Profits of a Latvian branch of a non-resident company are taxed on a normal assessment basis at the same rate as the profits of a resident company. There is no withholding tax on the remittance of taxed branch profits to the head office, whilst under the law in general a 10% withholding tax is imposed on the remittance of dividends out of taxed profits from a Latvian subsidiary.

The branch structure can be useful for a new business where start-up losses are expected, provided that these losses can be set off for tax purposes against profits arising in the country of residence of the head office. Latvia General Partnership

A general partnership is a company in which two or more partners operate under a common business name. A natural person or legal person may be a partner in a general partnership. All partners are jointly liable for the obligations of the general partnership with all of their assets.

A general partnership operates on the basis of a partnership agreement concluded by the partners which may be amended only with the consent of all partners.

Each partner may represent the general partnership in all legal acts unless the partnership agreement prescribes otherwise. The partnership agreement prescribes the amount of contribution to be made by the partners. A contribution may be monetary or non-monetary.

To enter a general partnership into the Commercial Register, a formal request for entry signed by all partners is submitted to the Commercial Register.

Latvia Limited Partnership

A limited partnership is a company in which two or more legal or natural persons operate under a common business name. At least one of the persons (general partner) is liable for the obligations of the limited partnership with all of the general partner’s assets, and at least one of the persons (limited partner) is liable for the obligations of the limited partnership to the extent of the limited partner’s contribution.

The state or a local government may not be partners in a limited partnership. Partners of a limited partnership agree on the business name, amount of contribution of the partners and headquarters of the limited partnership. A contribution may be monetary or non-monetary.

If a limited partner joins a general partnership, the general partnership shall be deemed to be transformed into a limited partnership. If all the limited partners leave or are excluded from a limited partnership and at least two general partners remain, the limited partnership shall be deemed to be transformed into a general partnership.

Choosing the most appropriate form:

Choosing the most appropriate form of presence is dependent on a number of factors.

When evaluating the choice between branch or subsidiary, the most important advantage of a subsidiary is limited liability. Branches do not have a separate legal identity, therefore, a creditor of a branch may make claims on the assets of the foreign entity. On the other hand, branches have certain other advantages, such as the option to transfer the branch's profit abroad without the imposition of withholding tax (5 – 10% withholding tax is applicable to dividends transferred abroad), and the facility to allocate head office expenses to the branch in proportion to the profit generated by the branch against that generated world-wide.

The choice of the form of presence also depends on the type of business to be conducted in Latvia. For example, banks and insurance companies in Latvia may only be established as JSC’s. Foreign banks have the option of operating in Latvia through branches.

If it is intended at some point to make shares of the company available for public sale, JSC would be the appropriate form as shares of LLC’s may not be offered to the public.

A representative office, in turn, may only be set up if no commercial activities are to be carried out. Usually representative offices are maintained for market research and promotional activities.

Overall, the most common choice of foreign investors is the LLC which is also the most popular form of incorporation for local businesses.

European Union Resident Permit

According to Council Regulation No. 1030/2002 residence permits in the European Union have uniform format, which means that residence permits have the same form in every Member State – it may be a sticker or stand-alone document containing particular information. It is useful to obtain residence permit in a Schengen zone country since it will entitle its owner to move without visa to other Member States of Schengen Agreement (a travel document with residence permit replace visa).

It must be noted that Latvia has joined Shengen area in 2007, and they provide for great opportunities to receive temporal residence permit through investments. For instance it is possible to receive residence permit in Latvia for up to 5 years by investing at least EUR 250 000 in a real estate or at least EUR 280 000 in a subordinated capital of Latvian credit institution (more information here). Along with main investor residence permit can be obtained by his/her spouse and minor children. The process of obtaining temporal residence permit takes from 1 up to 3 months.

General Company Compliance

Establishment Of Corporate Presence

Since company formation (LLC or JSC) is the most likely form of presence to be selected by foreign investors, the following is an outline of requirements for company incorporation:

Firstly, it should be noted that certain types of business activities are subject to the receipt of a license or permission from the responsible state or self-regulating institution. For example, a license is required for banks, insurance companies, insurance brokerage companies, customs warehouses, companies dealing with excise goods, and others. Regulated businesses may be subject to special capital requirements, requirements for the qualifications of management, etc. Therefore, in addition to the general requirements below, where applicable, requirements for obtaining licenses must already be explored at the incorporation stage.

Incorporation Documents

A number of prescribed incorporation documents must be drafted and submitted to the Commercial Register. Shareholders' signatures on any incorporation documents (foundation agreement or resolution, charter, application for registration), as well as sample signatures of Management Board members have to be certified by a notary public. If certified by a foreign notary, documents must also be authenticated in Latvia (apostilled according to Hague Convention of October 5, 1961 abolishing the Requirement of Legalisation for Foreign Public Documents) or legalised). Exceptions are documents certified in countries with which Latvia has signed bi-lateral treaties on legal assistance — Belarus, Estonia, Kyrgyzstan, Lithuania, Moldova, Poland, Russia and Uzbekistan.

Share Capital

The minimum share capital requirement is LVL 2 000 (EUR 3 400) for LLC’s and LVL 25 000 (EUR 42 500) for JSC’s.

The share capital of a company can comprise investment in cash or in kind. Cash investments must be endorsed by a notice from the bank showing payment to the temporary account of the company being established. Investment in kind in most cases must be evaluated by certified assessors selected from the list approved by the Commercial Register.< /p>

At least 50% of the share capital of a LLC must have been established by the date of submission of the incorporation documents to the Commercial Registry. JSC’s are required to demonstrate payment of at least 25% of the subscribed capital by the date of submission of incorporation documents, but the sum cannot be less than the minimum capital required for the establishment of JSC’s, which is LVL 25 000.

Management Of Companies

The Commercial Law requires a two-tier management system consisting of a Supervisory Board and a Management Board. However, the Supervisory Board is optional for LLC’s. As the titles of the bodies suggest, the Supervisory Board is designated to execute supervision over the Management Board of the company and to approve certain major transactions, while the Management Board is charged with daily management matters.

The law does not place any restrictions on the citizenship of members of the boards, however, at least half the members of the Management Board must be residents of Latvia. For LLC’s the Management Board may consist of only one member.

Schedule Time To Register With Companies Registrar

The period of review of incorporation documents and registration with the Commercial Register depends on the amount of state duty paid. For example, the standard duty for registration of LLC’s is currently LVL 100 (EUR 180) which allows registration to be completed within 2 weeks. However, registration may be completed within 4 or 2 days if, respectively, double or triple state duties are paid.

Most Used Entities In Latvia

Trading Companies

Latvian company is an ideal instrument for European and International trading. It has all the characteristics of any European company, but with additional benefits - low taxes, ease of set up, cost to register and own.

Latvia has one of the lowest corporate income tax in Europe - 15%, together with holding regime benefits (dividend tax at 0% rate) it becomes an ideal instrument for trading activities within and outside of EU.

In case of operations within EU requiring European VAT registration, the company may easily register for VAT in Latvia. Transactions on the territory of Latvia are subject to VAT at a rate of 21%, while for transactions between different EU countries VAT at 0% rate is applied.

Only margin, i.e.net profit after deduction of all business related expenses is subject to taxation. Thus effective tax rate may be reduced through expenses or using agency structure provided that transfer pricing rules are reasonably complied with.

The only restriction in trading activity is that payments to companies from tax-free countries included in so-called “black list" of the Cabinet of Ministers are subject to withholding tax 15%. This limitation can easily overcome, placing into tax schemes companies that are not included in the list.

European funds are accessible for setting up and development of production and services business.

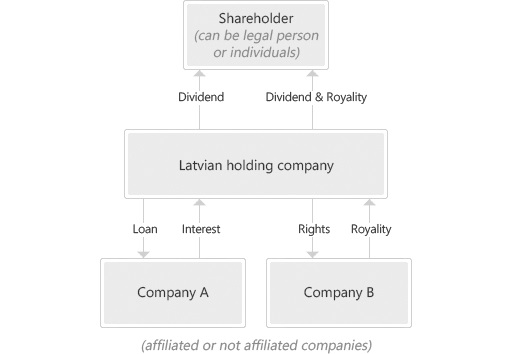

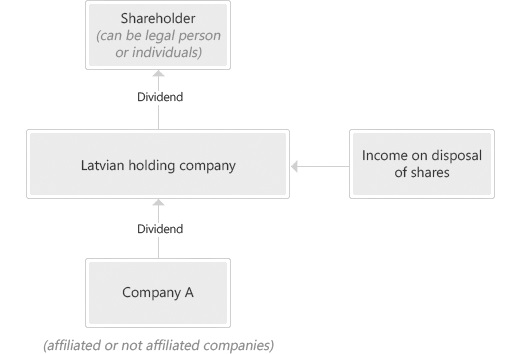

Latvia Holding Companies

Latvian company can be used as an International Holding company. Starting from 2013 Latvia introduce favorable regime for international holding, financial companies and companies holding intellectual property.

Current General Figures

Starting from 2013 favorable tax regime for international holding, financial companies and companies holding intellectual property becomes effective in Latvia:

Starting from 2013 sale of shares and dividends received are exempted from income tax for Latvian companies.

Starting from 2013 dividends paid to foreign companies are exempted from withholding tax.

Starting from 2014 interests and royalties paid to foreign companies are exempted from withholding tax. Even now in certain cases these payments are exempted.

No stamp duties on share capital payment and shares transfer.

No controlled foreign corporations rules for legal entities.

The effect of EU Parents-Subsidiary Directive and Interest and Royalties Directive, as well as extensive network of double tax agreements allow to reduce or avoid taxes withheld from dividends, interest, royalties and other income paid to Latvia.

Double tax agreements at the moment are effective with 51 countries, including almost all European countries, all post-Soviet countries, USA, Canada, China, Israel, Turkey, Singapore.

Holding regime has no restrictions on participating interest, holding period, type of activity of subsidiaries. The only limitation - it doesn’t apply to income received from and paid to tax-free countries included in so-called “black list” of Cabinet of Ministers.

Dividends paid from Latvia to individuals are subject to withholding tax 10%, reduced rate can be provided by double tax agreement. Possibility to set off may exist depending on the legislation of individual’s residence country or relevant tax convention (for example, citizens of post-Soviet countries can take this advantage).

Organisations that can assist with Latvia

-

> Blue Marble Global Payroll

Simplified Global Payroll Managing payroll across multiple countries is complicated – with unique requirements, systems, and deadlines in each country, it can be difficult to ensure compliance. Using manual processes or spreadsheets to manage payroll can lead to errors, data security issues, and penalties. Blue Marble solves your challenges with secure, cloud-based global payroll technology, aggregated monthly reporting, and in-country experts in 100+ countries.