Also in the news...

Foreign travel advice Indonesia

FCDO advises against all travel to parts of Indonesia.

Foreign travel advice Romania

Warnings and insurance Still current at: 24 April 2024 Updated: 23 April 2024 Latest update: Information related to drug offences and Romanian music festivals (under 'Laws and cultural differences' subheading on the 'Safety and security' page).

Foreign travel advice The Gambia

Warnings and insurance Still current at: 23 April 2024 Updated: 22 April 2024 Latest update: Ferry services between Banjul and Barra have been suspended until further notice; The Islamic Summit of the OIC (Organisation of Islamic Cooperation) will be held in Banjul on 4-5 May; road closures and delays at Banjul International Airport ('Safety and security' page).

Foreign travel advice China

Warnings and insurance Still current at: 23 April 2024 Updated: 22 April 2024 Latest update: Updated information on flooding (‘Safety and security’ page).

Guidance Living in South Korea

Information for British citizens moving to or living in South Korea, including guidance on residency, healthcare, driving and more.

Infrastructure boom in Southern Africa – creating unmissable opportunities for European companies

In April 2013, Messe München GmbH opened its’ doors in Munich/Germany to the world’s biggest trade show - the "International Trade Fair for Construction Machinery, Building Material Machines, Mining Machines, Construction Vehicles and Construction Equipment". InterGest was present to inform interested European companies about business in Africa in conjunction with the bauma Africa special on the 15th of April.

For the first time ever, bauma Africa will be opening its doors in Johannesburg/South Africa in September 2013. To underline the opportunities in the infrastructure sector in Africa, Messe München GmbH organised the bauma Africa Special. And the message was loud and clear:

There is more to Sub-Sahara Africa than raw materials and development aid.

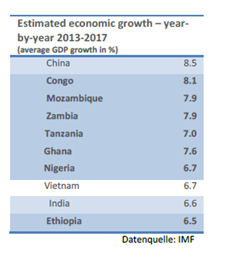

Experts across sub-Sahara Africa took to the stage to enlighten bauma exhibitors about Africa’s in-vestment potential, given the fact that seven out of ten of the fastest growing economies are located in sub-Sahara Africa.

Tanzania for example is expecting a population the size of Germany by 2020 with increased public revenue up to three times as high as the current level. Africa itself is estimating 2 billion people by 2050 on its continent. Many South African retailers have already realised the potential and successfully entered the markets in many neighbouring countries.

So far, most European companies are missing out on opportunities in Africa. China on the other hand has long discovered their chances on the hot continent.

Factors, indicating a reliable future growth in Africa, which at the same time decrease the risks of doing business in Africa, are the following:

- Africa is recording the highest urban growth rate worldwide

- Growing middle class

- Rising levels of education

- Noticeable improved political stability

- Abundance of natural resources (e.g. new natural gas discovery in Mozambique)

- Investment progress by African governments

- Establishment of Public Private Partnerships (PPPs)

Doing business in Africa is getting progressively easier. In 2000 South Africa’s Treasury incorporated regulations for Public Private Partnerships (PPPs) and a PPP unit has been established since. Other sub-Sahara governments follow suit in terms of regulating and supporting PPPs and understand their potential as South African Finance Minister Trevor Manuel once explained in 2004:”This is what PPPs are about. The public gets better, more cost-effective services; the private sector gets new business opportunities. Both are in the interests of the nation.”

One problem sub-Sahara Africa presents is the underdeveloped regional integration. Exporters are still facing restrictive trade and duty regulations. Adding hereto are social tensions as well as inefficient bureaucracy at times.

Opportunities in the construction sector

Given the high urban growth rates and the increase of Africa’s middle class, the entire infrastructure sector (housing, industrial development, water management, transport and energy) is the key focus of development efforts. Southern Africa’s infrastructure will need vital investment to meet the predicted 2040 demands in power, transport, water and the ICT sector.

Considering, that the road freight transport volume is expected to be seven times as high as the current traffic and the port throughput is expected to rise to two billion tons in the year 2040, a huge growth from its 2009 levels of 265 million tons, sub-Sahara Africa requires an updated, reliable and sustainable road-/ rail- and airfreight network.

Attractive Industrial Development Zones (e.g. COEGA) have been built to accommodate the need of global companies. South Africa’s Transnet National Ports Authority (TNPA) has invested R10 billion to date in the development of the deepwater Port of Ngqhurha, which is operated by Transnet Port Terminals (TPT).

The PIDA initiative - an initiative executed by the African Development bank (AfDB) and led by the African Union Commission (AUC), NEPAD Secretariat and the Bank – has highlighted investment opportunities within the infrastructure sector :

- Hydro power plants

- Transmission lines and interconnectors

- Oil and Gas pipelines

- Transport

- highway development and maintenance

- The Trans-Africa Highway (TAH) network

- The transport corridors

- The Africa hub port and railway projects

Water:

The predicted water need for the year 2040 requires Africa to invest in measures for sustainable water and wastewater management.

- Multi-purpose dams

- Water transfer projects such as Lesotho Highlands Water Project Management

- systems and infrastructure for river and lake basins

- planning and management of hydraulic infrastructure

ICT: By 2020, the information and technology demand will grow significantly. According to Simuyemba, chief infrastructure economist at AfDB, the demand will reach 6,000 gigabits per second by 2018, com-pared to 300 gigabits per second in 2009, while Africa catches up with broadband.

- National and regional integrated broadband infrastructure across Africa

- Internet infrastructure (exchange points) across Africa

Power: The power demand in Africa is estimated to increase from 590 terawatt hours (TWh / 2010) to to over 3,100 TWh by 2040. Hence it is a necessity that the installed power generation capacity increas-es from present levels of 125 GW to almost 700 GW in 2040, according to the AfDB.

- renewable energy and power generation projects

Focus South Africa

Consul Dumisani Dlomo’s (South African Consulate in Munich) message for the audience at the bauma Africa special was the following:

Africa is the theatre – South Africa is the stage

Due to being the largest and most developed export-based economy in Africa, South Africa does not record economic growth rates as high as its neighbours. According to IMF forecasts, South Africa is due to cross the 4% GDP growth barrier latest by 2015.

The construction industry in South Africa was experiencing a crisis in the last two years. Clear signs of a swift recovery are in sight, as the South African government announced in 2012 investments of R 845 billion ($ 100 billion) into the sustainable infrastructure development of the country across the whole sector :

- energy

- freight-/passenger-/ rail- / air traffic

- road construction / traffic planning and management

- port construction / management

- water / wastewater management

- IT- / communication infrastructure

Energy: South Africa's energy demand is expected to be twice the current level by 2030 due to an in-creasing focus on industrialisation, together with its mass electrification programme to take power into deep rural areas. Years of underinvestment and lack of maintenance in the country's power infrastructure is currently leading to a heavily increasing energy demand that Eskom (state-owned energy company, responsible for majority of energy generation and distribution) can’t meet anymore, resulting in desirable power cuts. The Department of Energy in cooperation with Eskom embarked on a R 340-billion spending pro-gramme to build new power stations.1

Rail traffic : Transnet, South Africa’s rail, port and pipeline company, expects overall railfreight volumes to increase from 200 million tonnes to 350 million tonnes by 2019 in addition to a substantial forecasted growth in mineral traffic. In the next seven years, Transnet plans to invest Rand 205bn ($US 25.9bn) in rail projects to meet the future demand.2

Wastewater: 1 600 wastewater treatment plants registered with the Department of Environment and Water Affairs, most of them – especially the plants in rural areas – are more or less dysfunctional and require extensive repair or maintenance measures.

Realise the potential in sub-Sahara Africa and contact us for more information. We look forward to hearing from you.

Your InterGest South Africa Team.

-------------

Sources : IMF, AfDB, http://www.tradingeconomics.com, www.southafrica.info, www.info.gov.za